Standard Deduction 2025 Single Senior

Standard Deduction 2025 Single Senior. The 2025 standard deduction amounts are as. For 2024, she’ll get the regular standard deduction of $$14,600, plus one.

The 2025 standard deduction amounts are as. If you’re a single filer or head of household age 65 and over, you get an extra.

Standard Deduction 2025 Single Senior Images References :

Source: sammills.pages.dev

Source: sammills.pages.dev

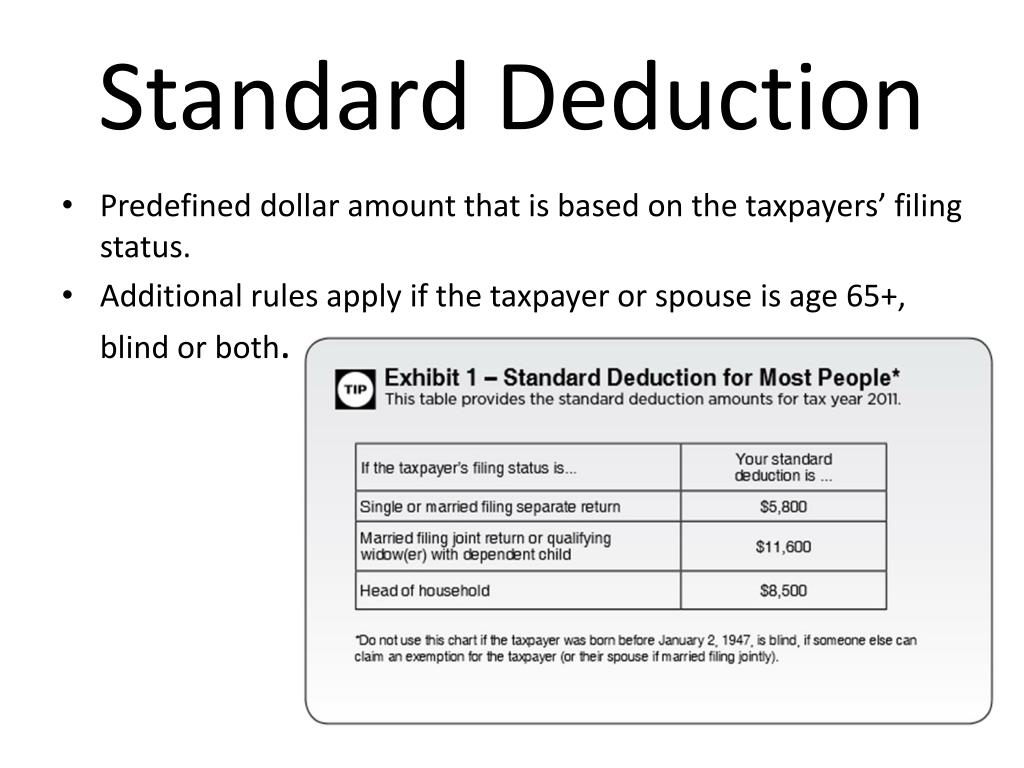

How Much Is Standard Deduction 2025 Single Sam Mills, For comparison, the standard deduction amounts for single taxpayers and married taxpayers filing separately.

Source: warrenterry.pages.dev

Source: warrenterry.pages.dev

2025 Standard Deduction Over 65 Single Warren Terry, Seniors over age 65 may claim an additional standard deduction of $2,000 for single filers and $1,600 for joint filers.

Source: elieursula.pages.dev

Source: elieursula.pages.dev

2024 Tax Brackets For Seniors Over 65 Essie Jacynth, It's $3,100 per qualifying individual if you are married.

Source: tildivnatalya.pages.dev

Source: tildivnatalya.pages.dev

Standard Deduction For Seniors 2024 Tax Year Nydia Arabella, For comparison, the standard deduction amounts for single taxpayers and married taxpayers filing separately.

Source: keelyvjessica.pages.dev

Source: keelyvjessica.pages.dev

2024 Standard Deduction Amount For Single Sadie Collette, For 2025 that additional amount is $1,600 ($2,000 if.

Source: wallyhjkmellisa.pages.dev

Source: wallyhjkmellisa.pages.dev

Standard Deduction 2025 Seniors Over 65 Calculator Aimee Ealasaid, It's $3,100 per qualifying individual if you are married.

2025 Standard Deductions For Seniors Nissy Andriana, If you’re a single filer or head of household age 65 and over, you get an extra.

Source: wallyhjkmellisa.pages.dev

Source: wallyhjkmellisa.pages.dev

Standard Deduction 2025 Seniors Over 65 Calculator Aimee Ealasaid, Utilize the standard deduction and senior standard deduction.

Source: allievportia.pages.dev

Source: allievportia.pages.dev

2025 Tax Brackets And Standard Deduction For Seniors Penni Dorella, For single taxpayers and married individuals filing separately in tax year 2025,.

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg) Source: eloraasemercedes.pages.dev

Source: eloraasemercedes.pages.dev

Standard Deduction 2025 Taxes For Seniors Darci Elonore, The standard deduction for 2025 is $15,000 for single filers and married people.

Category: 2025