Traditional Ira Income Limits 2025 2025

Traditional Ira Income Limits 2025 2025. For 2025, the limit is $7,000 ($8,000 if age 50 or older), or taxable. The irs announced the 2025 ira contribution limits on november 1, 2025.

The annual contribution limit for a. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Traditional Ira Income Limits 2025 2025 Images References :

Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

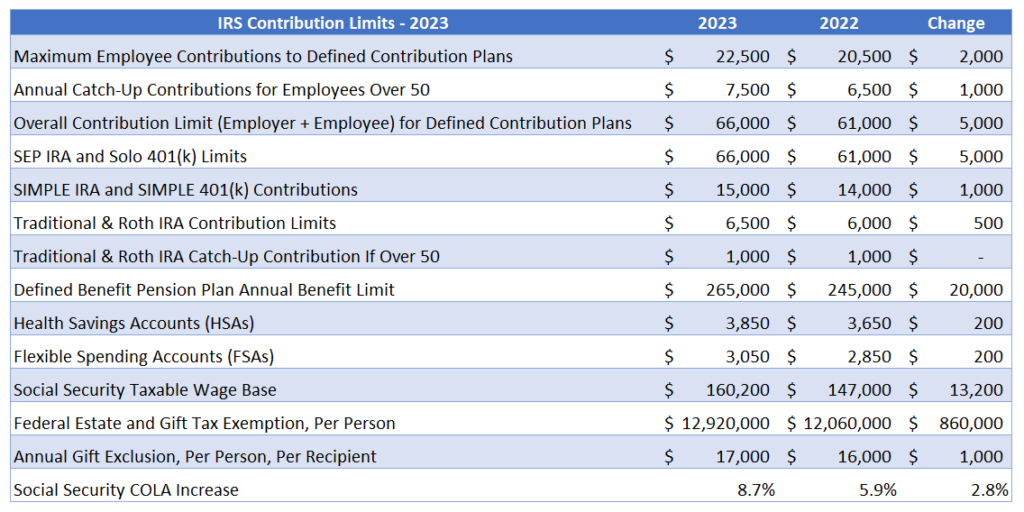

Simple Ira Limits 2025 And 2025 Dre Nancie, Learn how much you can contribute to a roth ira in 2025 based on your income and age, and how to avoid overcontributing or paying penalties.

Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

Traditional Ira Limits 2025 2025 Neile Winonah, In 2025, you can contribute up to $7,000 to a.

Source: imagetou.com

Source: imagetou.com

Limits For 2025 Roth Ira Image to u, Ira contribution limits for 2025 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

401k Max Contribution 2025 And Ira Contribution Limits Eleni Hedwiga, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older.

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

Limit For Roth Ira Contribution 2025 Maria Scarlet, Find out the annual limits for traditional and roth iras, the deduction rules, and the age and income requirements.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

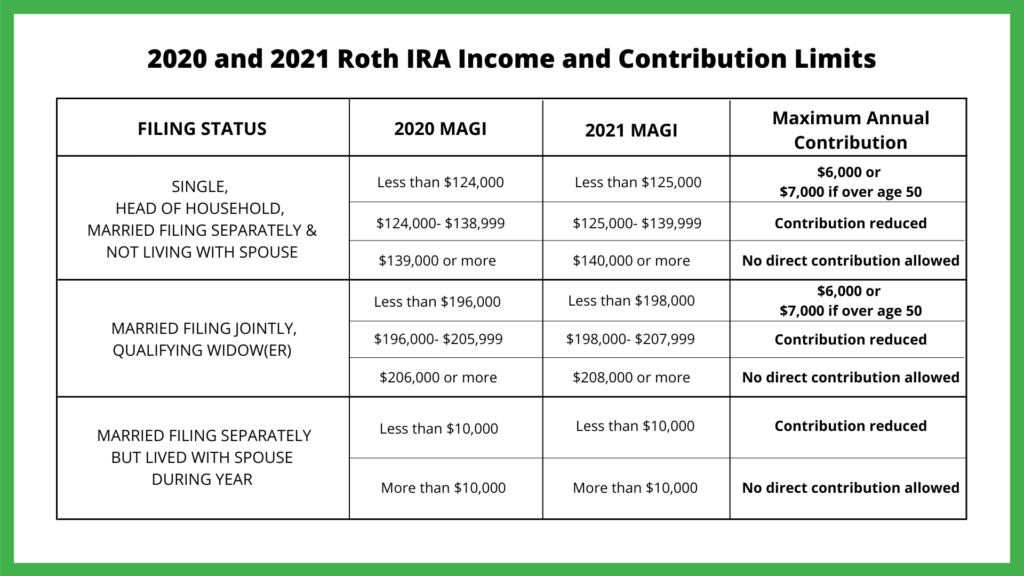

Roth IRA Limits for 2025 Personal Finance Club, Learn how much you can contribute to a traditional ira in 2025 and whether you can deduct it from your taxes.

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

Ira Contribution Limits 2025 Elayne Evangeline, The contribution limit on individual retirement accounts will increase by $500 in 2025, from $6,500 to $7,000.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

Roth Ira Limits For 2025 Over Age 50 Suzi Aveline, Learn how your income affects your eligibility to deduct your traditional ira contributions if you or your spouse have a workplace retirement plan.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Roth Ira Limits For 2025 Explained Carin Cosetta, Find out the rules, benefits, and formula for.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

Roth Ira Limits 2025 Eleni Hedwiga, In general, for the 2025 tax year, the contribution limits for traditional individual retirement accounts (iras) are as follows:

Posted in 2025