What Is The Standard Deduction For Single 2024

What Is The Standard Deduction For Single 2024. Itemized deductions can also reduce your taxable income, but the amount varies. 9, 2023, the irs announced the annual inflation adjustments for the 2024 tax year.

The standard deduction is a specific dollar amount that reduces the amount of income on which you’re taxed. Taxpayers can opt for old or new regime based on preferences.

Itemized Deductions Can Also Reduce Your Taxable Income, But The Amount Varies.

The standard deduction you can apply is $13, 850, which means you will only have to pay taxes on $36,150 of income.

People Should Understand Which Credits And Deductions They.

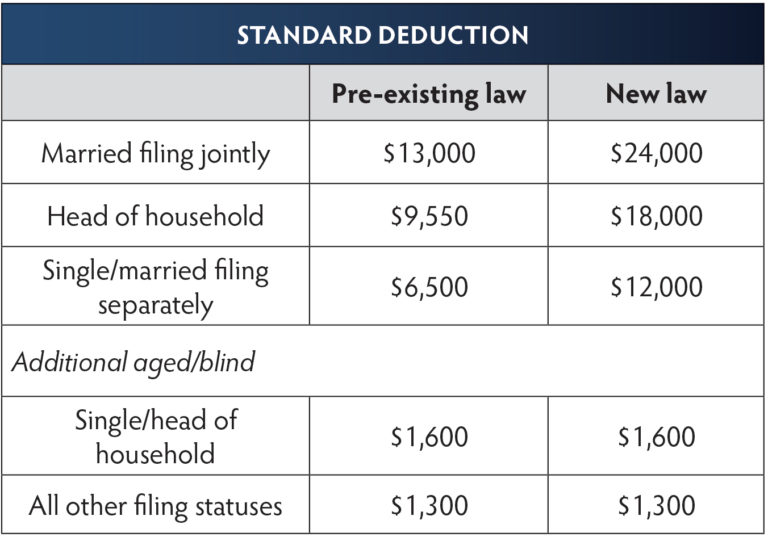

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

So If You Own Your Home, And Pay A Mortgage, And Live In A State With Income Taxes, You Might Be Able.

Images References :

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

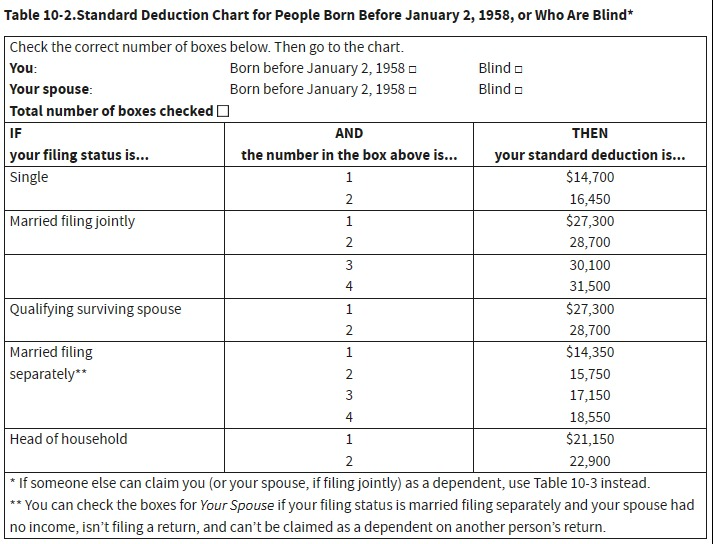

Irs New Tax Brackets 2024 Elene Hedvige, For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married. If you are 65 or older and blind, the extra standard deduction is:

Standard deduction amounts for 2021 tax returns Don't Mess With Taxes, Publication 501 (2023), dependents, standard deduction, and filing information. So if you own your home, and pay a mortgage, and live in a state with income taxes, you might be able.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Finance ministry clarifies no new tax changes from april 1, 2024. Family pensioners can also benefit from this deduction.

![What Is the Standard Deduction? [2023 vs. 2022]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg) Source: youngandtheinvested.com

Source: youngandtheinvested.com

What Is the Standard Deduction? [2023 vs. 2022], 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund. For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Publication 501 (2023), dependents, standard deduction, and filing information. For 2024, the standard deduction for dependents is limited to either $1,300 or the sum of $450 and the dependent's earned income, whichever is greater.

The IRS Just Announced 2023 Tax Changes!, The standard deduction gets adjusted regularly for inflation. Why has the standard deduction gone up?

Source: finaqlinell.pages.dev

Source: finaqlinell.pages.dev

What Is The Standard Deduction For 2024 Grata Brittaney, $3,700 if you are single or filing as head of household. To make an informed decision between the standard deduction and itemizing deductions,.

Source: standard-deduction.com

Source: standard-deduction.com

Standard Deduction 2020 Age 65 Standard Deduction 2021, Taxpayers can opt for old or new regime based on preferences. Standard deduction and personal exemption.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your, Finance ministry clarifies no new tax changes from april 1, 2024. Publication 501 (2023), dependents, standard deduction, and filing information.

Standard deduction Married filing jointly and surviving spouses Single, 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund. Your standard deduction consists of the sum of the basic standard.

The New Financial Years Starts From April 1.

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

How Much It Is, When To Take It.

People should understand which credits and deductions they.